Provisions of section 197 of the Income Tax Act, 1961 provides taxpayers the facility of lower tax rate or NIL deduction of TDS (TDS exemption). This section maintains a delicate balance between the requirement of cash flow to the taxpayer and realizing the government dues at the earliest.

Provisions of section 197 of the Income Tax Act, 1961 provides taxpayers the facility of lower tax rate or NIL deduction of TDS (TDS exemption). This section maintains a delicate balance between the requirement of cash flow to the taxpayer and realizing the government dues at the earliest.

Tax deducted at source, as per the Income Tax Act, is a percentage deducted as a tax from the payments such as salaries, professional fees, commissions, interest on investments, rent, etc. that exceeds certain threshold limits.

A person or company that is making the payment is accountable for deducting the tax and deposit it with the government is called a Deductor whereas the person or company receiving the net payment is called Deductee. Irrespective of the mode of payment – cash, cheque or credit – TDS is to be deducted and is linked to the PAN of both parties.

TDS is a kind of advance tax that needs to be deposited with the government periodically and the onus of doing the same lies on the deductor. For the deductee, the deducted TDS can be claimed in the form of a tax refund after they file their income tax return. Generally, the TDS rate varies from 1% to 30%.

Section 197 and 197A of the Income Tax Act, 1961 provides for the facility of NIL or lower tax rate deduction of TDS (or TDS exemption). If at the time of filing returns, the tax payer realizes that his tax liability is considerably less than what he actually paid, then he can claim the refund for the same. However, in case where the tax payer thinks that his tax liability for the year will be NIL or less than TDS rate applicable on a particular source of income, section 197 and 197A permits him to apply for a lower rate of TDS or no TDS. Taxpayer claiming low rate or no TDS needs to submit the application to the Assessing Officer (AO) in the prescribed form 13. In case the taxpayer does not apply for the certificate, they can still claim the refund in their annual return. Considering the merits of the case, AO issues a certificate seeking a list of customers of the assessee to neither deduct taxes nor deduct at lower rate.

In following scenarios one can opt for lower or no TDS:

This list is indicatory and subject to change on case to case basis.

It is mandatory to deduct TDS even if the assessee falls below the minimum tax bracket. However, in such scenario, assessee can avoid unnecessary TDS by filing Form 15G/15H to the banks or can submit lower/nil TDS certificate to the deductor.

As mentioned above, section 197 provides if the assessing officer is satisfied that the total income of the recipient justifies the deduction of tax at lower rates or no deduction should be made, shall grant a certificate for the same.

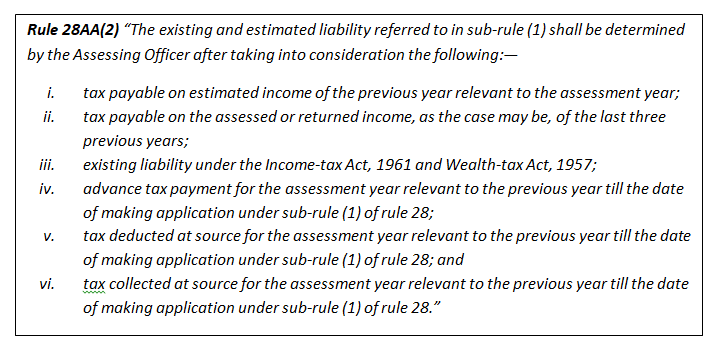

The mechanism for arriving at such satisfaction is provided under Rule 28 AA of the Income Tax Rule, 1962. As per Rule 28AA, the AO shall satisfy himself that existing and estimated tax liability of a person justifies the deduction of tax at lower rate or no deduction of tax. Sub rule 2 of the said rule is a complete code in itself depicting the parameters as well as conditions within which the determination is to be made.

Assessee needs to follow the below given procedure, if tax is deducted at source u/s 192, 193,194, 194A, 194C, 194D, 194G, 194H, 194I, 194J, 194LA, 195 but he feels that no or lower tax deduction of TDS should be done.

Lower tax rate or NIL deduction of TDS is not applicable under sections 194B, 194BB, 194DA, 194E, 194IA.

After receiving the certificate, deductor has to validate the PAN details, check validity for current financial year and correct the certificate number. He raises flag A in a statement for a certificate u/s 197 and flag B for certificate u/s 197A.

The application for lower or no TDS u/s 197 is to be made by the taxpayer to AO in a predefined format i.e. Form 13. Following information is to be furnished:

Under the provisions of section 197A, if any individual or a Hindu Undivided Family (HUF) has divided their income under Section 2(22)(e) or interest income under Section 57 is

a) not exceeding the exemption limit and;

b) the tax liability is also nil,

Then such assessee can furnish a self-declaration in Form 15G to the person who is liable to pay such dividend (or interest). In such cases, no tax is to be deducted at source.

Self-declaration under the Form 15H is to be submitted by the assessee who is above 60 years of age and whose tax liability is supposed to be nil. No deduction of tax at source is made at the time of disbursement of income to such assessee.

Notwithstanding anything contained in this section, no deduction of tax shall be made by the Offshore Banking Unit from the interest paid when:

1) deposit made on or after the 1st day of April 2005, by a non-resident or a person not ordinarily resident in India; or

2) borrowing on or after the 1st day of April 2005, from a non-resident or a person not ordinarily resident in India.

The certificate issued under Section 197 is only valid for the assessment year mentioned in the certificate unless it is cancelled or the date mentioned on the certificate expires.

We appreciate you contacting us at India Law Offices. We will review the details that you have submitted and one of our experts will connect with you shortly.

Here are some of the other related articles authored by our experts which might be of interest to you.