A director plays several roles in a company - as an agent, as an employee, as an officer, as a trustee of the company. Fittingly, the payments made to directors of the Company bear different components basis the terms of agreement with the company. Taxability of directors remuneration under Indirect tax law has been fractious since 2012 when reverse charge on directors remuneration was introduced under erstwhile service tax regime and continued under GST regime. This article aims to provide insight on diverse nature of payments to directors and its GST applicability vis-à-vis advance rulings and clarifications issued under GST law on this subject.

Nature of Payments to Directors:

Ordinarily, the payments made by Company to its director are in the nature of compensation for services or employment enumerated as under:-

- Salary or Managerial Remuneration:- The Whole time or Managing Director is paid a salary on monthly basis, the component of which can be monetary as well as non- monetary being benefits in kind such as in the nature of car, health insurance.

- Bonus/ Incentive:- The Whole time or Managing Director are paid bonus and incentive based on their performance.

- Stock/ Share option - Executive stock options are the most common form of long-term market-orientated incentive scheme. Share options are contracts that allow the executive to buy shares at a fixed price or exercise price. These are provided to Whole time or Managing Director basis their performance or agreement with the Company.

- Sitting Fee:- The Directors of the Company such as Whole time Director, Managing Director, Non-Executive Director or Independent Director are paid remuneration by way of fee for attending the Board Meetings of the Company.

- Reimbursement of Expenses/ Imperest Expense:- Reimbursement of actual expenses such as travel, boarding & lodging, other expenses are being paid by the Company

- for business purpose to Whole Time or Managing Director or

- for attending the Board Meeting of the Company to Non executive or Independent Directors

- Profession/ technical fee:- Usually, independent or Non-executive directors are paid fees for provision of professional or technical service of their expertise. Managing or Whole Time Directors are also paid such fees as per terms of their contract with the Company.

- Commission or Brokerage:- The Company may also pay commission or brokerage as percentage of Net profits to the Whole time, Managing Director or Non-Executive or Independent Directors of the Company.

- Rent:- The Company also pays rent to the Director in case the premises/ space of the Director has been provided on lease or rent to the Company.

- Loan:- The Company repays loan taken from the director taken for business purpose.

- Interest on Loan:- The Company pays interest on loan to the director.

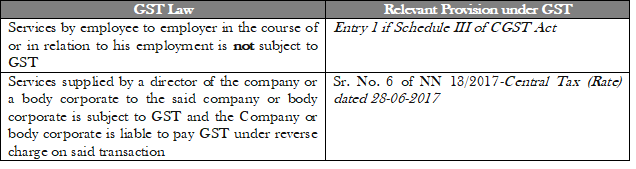

Present GST Law on applicability of GST on payments to Directors:

On conjoint reading of above, GST is not levied in respect of services provided by director to the company under employee and employer relationship. However, services other than in the nature of employment would attract GST under reverse charge mechanism.

Though the law appears simple at the face of it but the issue of taxability of directors remuneration has constantly vexed the companies since inception due to

- Issue of notices by department on Company:- During audits, department has taken view and issued notices to the Company in the past that the Directors are not the employees of the company and thus tax under reverse charge is applicable on the remuneration paid to the directors.

- Advance rulings under GST:- The Authority for Advance ruling (AAR) in various cases [such as Alcon Consulting-Karnataka(2019), Clay Craft- Rajasthan(2020)] ruled that GST is applicable to directors remuneration under RCM basis the reasoning that the director is not an employee of the Company.

It is imperative to mention here the moot question whether the payments made to directors are in the nature of employer employee relation or not and other facts such as TDS on Directors salary, applicability of PF laws on Directors payment were not considered by the Department and the Hon’ble AAR while concluding the taxability of director’s remuneration.

Thus, recently, GST Department has also issued Circular on June 2020 deliberating on the moot question whether the director is the employee of the company or not by distinguishing remuneration paid to independent director and remuneration paid to the whole time director of the Company. The Circular established the below criteria for leviability of GST on director’s remuneration.

- Independent directors or those directors who are not the employee of the said company:- GST to be payable under reverse charge by the Company on remuneration paid to such directors.

- Directors who are also an employee of the said company such as whole time director:-

- Director’s remuneration declared as `Salaries’ in the books of a company and subjected to TDS under Section 192 of the Income Tax Act:- NO GST applicable on such remuneration paid to directors.

- Director’s remuneration which is declared separately other than ‘salaries’ in the Company’s accounts and subjected to TDS under Section 194J of the Income Tax Act:- Such remuneration is the fees for professional or technical Services and GST to be payable under reverse charge by the Company on remuneration paid to such directors.

Thus, the Circular has placed substantial reliance on the accounting head declared by the Company in the books of accounts and nature of tax deduction at source under the Income Tax as the basis for establishing employer employee relationship and subsequent applicability of GST on director’s remuneration.

It will not be out of context to mention here below case laws in this respect:-

- Hon’ble Allahabad High Court in the case of Sardar Harpreet Singh VS CIT (1990) observed that the nature of employment may be determined by the articles of association of the company (AOA) or agreement, if any, between the company and the person concerned.

- PCM Cement Concrete VS Commissioner (2018), the Central Excise and Service Tax Appellate Tribunal held that all remuneration received by whole time directors was received in the capacity of an employee and therefore not subject to service tax. However, the Revenue Department has challenged said judgment before Supreme Court and is pending as on date.

Conclusion:

Though the circular has rationalised the view on applicability of GST on remuneration paid to directors, however, pending judgment before supreme court for said issue and observation of Allahabad Supreme court as AOA/ agreement as criteria and not the basis of nature of TDS for establishing employer employee relationship. Thus, the companies must also look at the terms of employment agreement/ service contract with the directors apart from accounting head or nature of TDS to establish employer employee relationship and subsequent applicability of GST on remuneration paid to them.

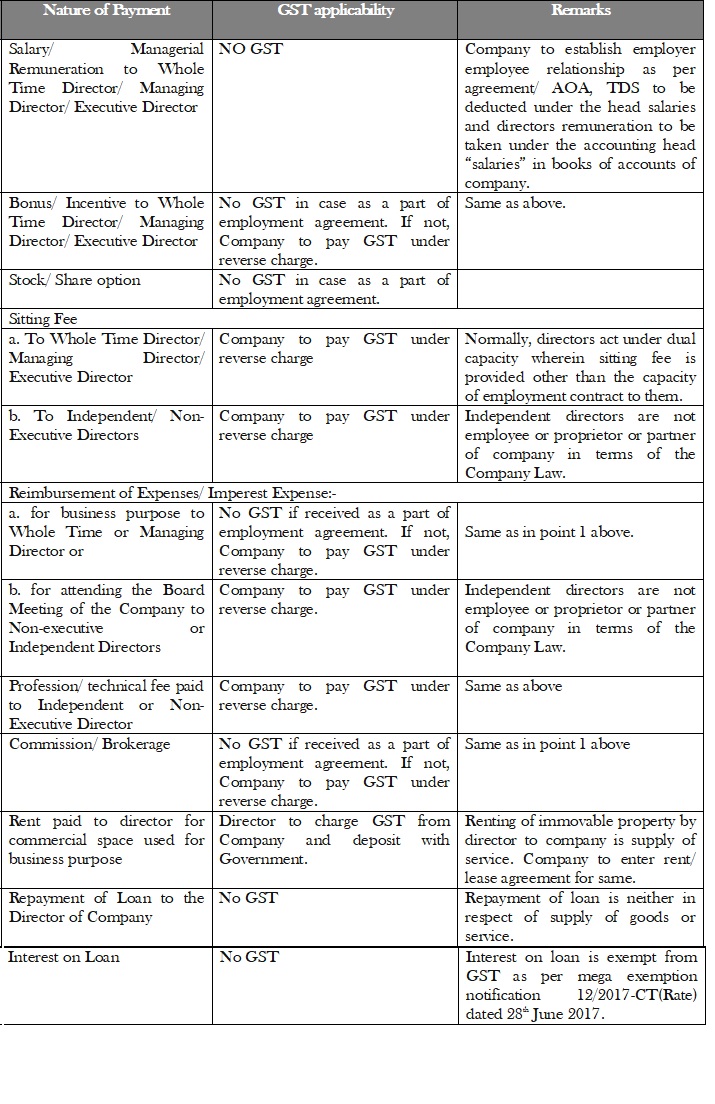

Basis varied nature of payments to director and GST law on same, attempt has been made to summarise GST applicability on said payments as under:-