Enactment of GST law in India carry forward the erstwhile VAT & Service Tax law concept of consumption based tax established on the principle of tax on value addition with the intention to mitigate cascading effect of Input Tax Credit (

ITC). Further, the anomaly of inverted duty structure resulting in additional taxes borne by taxpayers has been addressed in GST law by way of refund of unutilised credit. Though the GST Act endeavours to pass on the GST credit on goods as well as services, however, a contrary amendment was made in refund rules under GST in 2018 with retrospective effect restricting the credit related to goods only on account of inverted duty structure. In other words, refund of input tax credit availed on input services has been denied by said amendment with retrospective effect i.e. w.e.f. 1

st July, 2017 on account of inverted duty structure. This resulted in withholding of tax credit on input services by the Government supressing the legislative intent.

Recently, for the very first time in a landmark judgment by Gujarat High Court in the matter of VKC Footsteps India Pvt. Ltd. Vs. Union of India declared said amendment as ultra-virus the provisions of GST Act thereby allowing the refund of unutilised credit of input service on account of inverted duty structure.

This article lays emphasis on issue pertaining to Inverted duty structure, analysis of Gujarat High Court judgment and challenges (

in taking the benefit of judgment) before businesses especially textile manufacturing industry, footwear, e-commerce, tyre, handloom, railway locomotive & parts, solar module, mobile phones, steel utensils, fertilizers, tractors, pharmaceutical, etc.

Inverted Duty Structure – Issue Explained

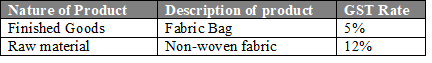

Inverted Tax Structure’ is a scenario where the rate of tax on inputs purchased is more than the rate of tax on output supplies. It is to be noted that these supplies do not include NIL rated or fully exempt supplies. Said scenario is illustrated as under:-

Section 54(3) of the Central Goods and Service Tax (CGST) Act, 2017 provides for refund of unutilised input tax credit on account of inverted duty structure i.e. where the credit is accumulated due to higher tax rate on inputs than output supplies.

Rule 89(5) of the CGST Rules, 2017 provides the formula for determining the refund on account of inverted duty structure. Notification No. 21/2018-CT dated 18.4.2018 prescribed the revised formula for refund of input tax credit in this respect w.e.f. 01st July 2017.

|

Net ITC shall mean input tax credit availed on inputs during the relevant period other than the input tax credit availed for which refund is claimed under sub-rules (4A) or (4B) or both “Adjusted Total turnover” and “relevant period” shall have the same meaning as assigned to them in sub-rule (4) The above revised formula inter alia excluded input services from the scope of Net ITC for determining refund on account of inverted duty structure as clarified by CBIC vide Circular No. 79/53/2018-GST dated 31st Dec 2018 relevant experts of which is reproduced hereunder:- Section 2(59) of the CGST Act defines inputs as any goods other than capital goods used or intended to be used by a supplier in the course or furtherance of business. Thus, inputs do not include services or capital goods. Therefore, clearly, the intent of the law is not to allow refund of tax paid on input services or capital goods as part of refund of unutilized input tax credit. Accordingly, in order to align the CGST Rules with the CGST Act, notification No. 26/2018-Central Tax dated 13.06.2018 was issued wherein it was stated that the term Net ITC, as used in the formula for calculating the maximum refund amount under rule 89(5) of the CGST Rules, shall mean input tax credit availed on inputs during the relevant period other than the input tax credit availed for which refund is claimed under sub-rules (4A) or (4B) or both. In view of the above, it is clarified that both the law and the related rules clearly prevent the refund of tax paid on input services and capital goods as part of refund of input tax credit accumulated on account of inverted duty structure. (emphasis supplied) Gujarat High Court Judgment – Observations and ruling The Hon’ble High Court observed as under:-

- The formula prescribed under Rule 89(5) of the CGGST Rules, 2017 to exclude refund of tax paid on “input service” as part of the refund of any unutilised input tax credit is contrary to the provisions of Section 54(3) of the CGST Act, 2017.

- Section 2(63) of the CGST Act defines “input tax credit” as credit of input tax. Further, Section 2(62) defined “input tax” as tax charged on any supply of goods or services or both made to any registered person. Thus “input” and “input service” are both part of the “input tax” and “input tax credit”.

- As per provisions of Section 54(3) of the CGST Act, law provides that registered person may claim refund of “any unutilised input tax”.

- By way of Rule 89(5), claim of the refund cannot be restricted only to “input” excluding the “input services” from the purview of “Input tax credit”.

- Clause (ii) of proviso to Section 54(3) of the Act (ibid) also refers to both supply of goods or services and not only supply of goods as per amended Rule 89(5) of the Rules (ibid).

It was held as under: -

- Intent of the Government by framing the Rule restricting the statutory provision cannot be the intent of law as interpreted in Circular No. 79/53/2018-GST dated 31.12.2018 to deny the registered person refund of tax paid on “input services’ as part of a refund of the unutilized input tax credit.

- Explanation (a) to Rule 89(5) is ultra-vires to the provisions of Section 54(3) of the CGST Act, 2017.

- Net ITC should mean “input tax credit” availed on “inputs” and “input services” as defined under the Act.

- The respondents are directed to allow the claim of the refund made by the petitioners considering the unutilized input tax credit of “input services” as part of the Net ITC for calculation of the refund of the claim as per Rule 89(5) of the CGST Rules,2017 for claiming refund under Section 54(3) of the CGST Act, 2017.

Challenges before businesses post landmark Gujarat HC ruling

The taxpayer operating in an inverted tax structure scenario is now eligible for a higher refund of unutilized ITC pertaining to input services and thereby improving the cash flow of the businesses. However, the relevant industry would be facing the below challenges with respect to the applicability of said ruling: -

- The taxpayers may face practical application of Gujarat High Court judgment by GST authorities, especially outside Gujarat jurisdiction.

- Refunds already filed by taxpayers and granted by GST authorities with respect to goods only. In the past, while applying the formula of refund as per Rule 89(5) of the CGST Rules, 2017 various taxpayers did not claim the refund of ITC on input services. There can be cases where, taxpayers might have added said ITC to its cost, or such refunds of ITC on input services have been rejected by the GST authorities.

- The limitation period for claiming a refund for a relevant year is two years and therefore it would be the foremost procedural challenge in online applying refund for the past period.

The taxpayers are suggested to analyse the judgment basis the facts and circumstances of their case in practically applying the judgment. This is pertinent to mitigate the hitches in the process of applying refund of unutilised credit on account of inverted duty structure and seek expertise assistance wherever required.