The Central Board of Indirect Taxes and Customs (CBIC) has indicated a strong prospect of an instantaneous surge in the imports and export of India once the spread of the COVID-19 is brought fully under control and expects the disruptions in the supply chains to settle by May 2020.

The Central Board of Indirect Taxes and Customs (CBIC) has indicated a strong prospect of an instantaneous surge in the imports and export of India once the spread of the COVID-19 is brought fully under control and expects the disruptions in the supply chains to settle by May 2020. Apart from Imports and Exports, there are varied transactions taking place before filing of bill of entry whereby the original importer of goods sells the subject goods to a third person before the goods are entered for customs clearance i.e. High Sea Sales (“HSS”). In this article we would lay emphasis on the various tax implications on High sea sales and how the companies can save tax.

The Central Board of Excise & Customs vide Circular No. 33/2017-Cus dated August 01, 2017 (“The Circular 33/2017”) provides that ‘High Sea Sales’ is a common trade practice whereby the original importer sells the goods to a third person before the goods are entered for customs clearance. After the High sea sale of the goods, the Customs declarations i.e. Bill of Entry etc is filed by the person who buys the goods from the original importer during the said sale.

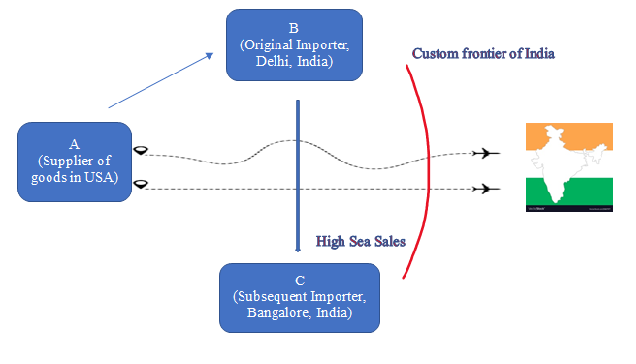

Thus, HSS is a sale where the importer sells the goods to another buyer on or after the goods are dispatched from the port of loading (i.e. harbour or airport) in the exporter’s country and before the arrival at the destination port/ airport for custom clearance. However, the sale post arrival at the port/ airport but before the custom duty clearance would not amount to High Sea sale. Under HSS, the sale should happen while the goods are still on high seas/in the air or after dispatch from the port/ airport of exporter’s country and before reaching port/ airport for custom clearance/ custom frontier of destination country. This is well explained in the diagram below:-

In the above example, “A” located in the USA sells goods to “B” being an original Importer in Delhi, India. The goods are exported from the USA and when the goods are in transit, B enters into an agreement with “C” in Bangalore, India wherein B sells the goods to C while the goods are still in the air/ high seas i.e. before the goods cross the customs frontier of India. Now said sale between original importer B in Delhi and C in Bangalore while the goods are in transit is called High Sea Sales and the agreement of sale between them is called High Sea Sale Agreement with B being HSS Seller and C being HSS buyer.

At this point it is imperative to mention that in the example above, there are two transactions i.e. one between A (overseas exporter) and B (original importer) and the second between B and C (ultimate importer). The transaction between A and B gets completed overseas only as soon as B enters into HSS agreement with C. Hence, there is no indirect tax liability in India on B over the transaction between A and B in such a case since the transaction has gotten completed before the goods reached the customs frontier of India.

However, to understand the indirect tax implication upon the transaction between B and C being HSS and the indirect tax liability on import, the same has been deliberated hereinafter.

Before analysing the tax implications on HSS transactions, it is imperative to understand the duties and taxes levied on the import of goods into India and if the same are applicable on high sea sales transactions in respect of the goods which are subsequently imported into India.

The laws under the Custom Act, 1962 and the Goods and Services Tax Act, 2017 are applicable on goods imported into India and accordingly taxes namely the Basic Custom duty (BCD), Integrated Goods and Service Tax (IGST) and Cess (Education Cess & Compensation cess) is applicable on import of goods at applicable rates.

Applicability of BCD on High Sea sale:- Territorial water extends up to 12 nautical miles into the sea from the coast of India and so the liability to pay import duty commences as soon as goods enter the territorial waters of India. Thus, no duty is liable on goods which are in transit and accordingly a high sea sale transaction is NOT subject to BCD.

Thus in our above example, the HSS transaction between the HSS seller “B” in Mumbai and the HSS buyer “C” in Bangalore while the goods are in transit is not subject to BCD.

However, when the goods cross the custom frontiers of India, C being the ultimate importer of goods is required to pay BCD on the import of goods @ 10%.

Applicability of IGST on High Sea sale:- As mentioned above, IGST is levied and collected on import of goods into India in accordance with the Customs. Since BCD is not applicable on the HSS transaction, accordingly, IGST is also not payable on HSS transaction. The same has been substantiated by law vide The Circular 33/2017 and subsequent amendment vide CGST amendment Act, 2018:-

“8 (b) Supply of goods by the consignee to any other person, by endorsement of documents of title to the goods, after the goods have been dispatched from the port of origin located outside India but before clearance for home consumption.”

Thus in our above example, the HSS transaction between the HSS seller “B” in Mumbai and the HSS buyer “C” in Bangalore while the goods are in transit is not subject to IGST.

However, when the goods cross the customs frontiers of India, C being the ultimate importer of goods is required to pay IGST on the import of goods under a reverse charge at the relevant rate.

Cess:-In addition to IGST, GST compensation cess may also be leviable on certain luxury and de- merit goods under the Goods and Services Tax (Compensation to States) Cess Act, 2017 on the import of those goods.

Surcharge:- Further, Social Welfare Surcharge is also levied on the value of goods imported including BCD valued @ 10% unless the goods are exempted from tax in terms of the Customs Act, 1962.

Applicability of Cess & surcharge on a High Sea sale:-As mentioned above, since the BCD and IGST are not applicable on the HSS transaction, accordingly, cess and surcharge is also not payable on HSS transactions.

Thus in our above example, the HSS transaction between HSS seller “B” in Mumbai and HSS buyer “C” in Bangalore while the goods are in transit is not subject to Cess and surcharge.

However, when the goods cross the customs frontiers of India, C being the ultimate importer of goods may require to pay Cess on the import of goods under reverse charge at relevant rate if such goods are those mentioned under Goods and Services Tax (Compensation to States) Cess Act, 2017 and Social Welfare Surcharge unless the goods are exempted.

Points to be kept in mind while doing HSS transaction to save tax (BCD, IGST and Cess), else such taxes will get attracted

Thus, notarisation is pertinent in order to determine the time of entering into HSS agreement or contract.

If any mistakes are made in filing of the IGM, the import customs clearance documents cannot be accepted, as the details of such documents have to be matched with the details in the IGM. Therefore, it is pertinent that the IGM must contain correct information relating to ultimate importer of goods.

For instance in our above example, if the consignee name is not changed from B in Delhi to C in Bangalore in IGM, such a sale transaction will attract applicable duties and taxes and only B can clear the goods from customs on payment of duties and taxes.

We appreciate you contacting us at India Law Offices. We will review the details that you have submitted and one of our experts will connect with you shortly.

Here are some of the other related articles authored by our experts which might be of interest to you.