Four years back when the Government of India started a flagship initiative with the intention to build strong eco-system for nurturing innovation and start-ups in the country. In order to promote the initiative, various relaxations were provided for startups namely simplifying the incorporation process, funding support, tax benefits, tax exemptions, etc. Since then, the initiative has driven sustainable economic growth, generated large scale employment opportunities and boost up the entrepreneurship in India.

Further, cogitating the recent unprecedented times, Invest India is constantly encouraging organizations in the supply of critical health and safety supplies and equipment, including personal protective equipment (PPE Kit), treatment equipment, diagnostic and testing products, essential medicines and components. It therefore becomes imperative to understand what are tax benefits available to eligible start-ups, what are the organizations that are eligible for tax exemption and benefits i.e. criteria for eligible startup and what is the procedure for registration. This article will give insight and revert such questions with respect to provisions under Start up India program.

TAX BENEFITS AVAILAIBLE UNDER START UP INDIA PROGRAM

Gist of tax benefits for eligible Start-ups is summarized below for the ease of readers.

Tax Exemption on Investments above Fair Market Value (FMV)

This exemption has been provided to encourage see capital investments in eligible start-ups. Thus, tax levied on investments above FMV in such start-ups are exempted from income tax in India.

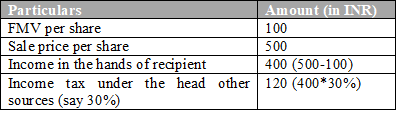

As per Income Tax law in India, income on investments in companies above FMV is subject to income tax as “Income from Other Sources” in the hands of recipient of said income. For instance

The Government under start up India program has exempted the income arising on sale of share over and above FMV value w.r.t. sale of share of such start-ups. In other words, in our above example INR 400 will be exempt and INR 120/- tax will not be levied.

This has been done keeping in mind the hardship caused to start up due to its initial conceptualization & development phase where the FMV of its share is significantly low (lower than the value at which capital investment is made in majority of cases) resulting in huge levy of taxes.

Currently, exemption is provided on such income in respect of investments made by angel investors, family or funds which are not registered as venture capital funds, incubators.

Tax Exemption to start up for 3 years

This exemption has been provided to promote the growth of Startups and address their working capital requirements.

The Government of India has provided 100% tax incentive for a period of 3 consecutive years out of 10 years from the year of incorporation subject to condition that eligible start-up is incorporated on or after 1st April’ 2016 but before 1st April’ 2021 and total turnover of its business does not exceed 100 crore Indian Rupees.

This exemption facilitate growth of business and meet the working capital requirements during the initial years of operations.

(Note: Earlier, the block period was 7 years and the turnover limit was 25 crores Indian Rupees till 31-03-2020. Finance Act 2020 has increased the period from 7 years to 10 years and enhance the turnover limit from 25 crore rupees to 100 crore rupees w.e.f. 01-04-2020)

Tax Incentive on Employee Stock Payment Plan (ESOPs)

As per Income Tax law in India, ESOPs i.e. security or sweat equity shares are taxable as perquisite.

In order to ease the burden of payment of taxes by the employees of the eligible start-ups or TDS by employer, Finance Act, 2020 provided tax incentive to eligible start ups enumerated as below.

W.e.f. 01-04-2020, tax or interest on income on allotment or transfer of ESOPs i.e. security or sweat equity shares by eligible start-up to its employees, is required to be paid by the assessee within 14 days of below whichever is earlier:

(i) after the expiry of 48 months from the end of the relevant assessment year

(ii) from the date of the sale of such specified security or sweat equity share by the assessee

(iii) from the date of which the assessee ceases to be the employee of the person

[Note:- Tax is to be paid based on rates in force of the financial year in which the said specified security or sweat equity share is allotted or transferred]

Tax Exemption on Capital Gains

This exemption has been provided to promote investments into Startups by mobilizing the capital gains arising from sale of capital assets. The exemption has been provided on below areas:-

- Exemption from Long Term Capital Gain (LTCG)

A new section 54EE has been introduced under Income Tax Act, 1961 wherein exemption has been provided on LTCG of eligible startups subject to conditions namely:-

- such LTCG is invested in funds notified by Central Government i.e. long term specified asset

- such investment is made within six months from the date of transfer of asset.

- Maximum amount that can be invested is INR 50 lacs

- Minimum lock-in period of new acquired long term specified asset is 3 years

- Exemption on Capital Gain if invested in eligible Start-up

Exemption is provided vide Section 54 GB of the Income tax act wherein no tax is levied on capital gains arising out of sale of residential house or a residential plot of land if the amount of net consideration is invested in prescribed stake of equity shares of eligible Startup for utilizing the same for purchase of specified asset.

[Note:- The condition of minimum holding of 50% of share capital or voting rights in the start-up relaxed to 25%. Further, the period of extension of capital gains arising from for sale of residential property for investment in start-ups has been extended up to 31st March 2021]

- Tax benefit on carry forward of loses

Startups can carry forward their losses on satisfaction of any one of the following two conditions:

- Continuity of 51% shareholding/voting power or

- Continuity of 100% of original shareholders

CRITERIA FOR ELIGIBLE START-UP

The organizations or companies can avail the benefit of tax exemption and tax incentive mentioned above if they fulfil the criteria of eligible start-ups. An entity is considered as eligible start-up on satisfaction of below conditions:

- Upto a period of ten years from the date of incorporation/ registration, if it is incorporated as a private limited company (as defined in the Companies Act, 2013) or registered as a partnership firm (registered under section 59 of the Partnership Act, 1932) or a limited liability partnership (under the Limited Liability Partnership Act, 2008) in India.

- Turnover of the entity for any of the financial years since incorporation/ registration has not exceeded 100 crore rupees.

- Entity is working towards innovation, development or improvement of products or processes or services, or if it is a scalable business model with a high potential of employment generation or wealth creation.

- The entity should not be formed by splitting up or reconstruction of an existing business.

- An entity shall cease to be a Startup on completion of ten years from the date of its incorporation/ registration or if its turnover for any previous year exceeds 100 crore rupees.

PROCEDURE FOR RECOGINITION OF ELIGIBLE START-UP

The he process of recognition of an eligible entity as start-up is enumerated as under: —

- A Startup shall make an online application over the mobile app or portal set up by the Department for Promotion of Industry and Internal Trade (DPIIT). There is no statutory fees for such recognition for such start-ups.

- The application shall be accompanied by relevant documents namely copy of certificate of Incorporation/ registration, write-up about the nature of business highlighting how it is working towards innovation, development or improvement of products or processes or services, or its scalability in terms of employment generation or wealth creation.

- On satisfaction of documents, the DPIIT either recognise the eligible entity as Startup or reject the application by providing reasons.