Recently the Government of India has laid down new rule under Income Tax law for determining the residential status of Non Resident Indian (NRI). Acknowledging the hardship caused due to COVID-19, clarifications has also been issued setting norms with the aim to provide relaxation in determining tax residency status of NRI. However, prior to lockdown, in budget 2020, contrasting amendment was made with respect to tax residential status of NRI making it more stringent.

This article will serve as a compendium with meticulous analysis of the recent criteria vis-a-vis amendment in Finance Act 2020 and clarification issued pertaining to determining tax residency status of NRI for FY 2019-20 and FY 2020-21.

New Rule to determine residential status of NRI – Finance Act 2020

The Finance Act, 2020 brought fundamental amendment in the provisions of residential status of individual who is Indian citizen or a person of Indian Origin from FY 2020-21 onwards.

As per Income Tax laws in India, an individual who is Indian citizen or a person of Indian origin qualifies as resident in India during a financial year on satisfaction either of below conditions:-

Condition 1:- Stay in India for 182 days or more during the financial year or

Condition 2:- Stay in India for 365 days or more during preceding 4 financial years

In this respect, Finance Act 2020 has made below amendment effective from 01-April-2020:-

In Condition 1:- The above period of 182 days reduced to 120 days for Indian citizen or a person of Indian origin who being outside India and visits India. However, reduced period of 120 days shall apply only in cases where the income accruing in India of such individuals during the financial year is more than Rs 15 lacs. In other words, the scenario remains the same for such individuals whose taxable income in India is less than Rs 15 lacs.

This amendment will effect the individuals who are essentially carrying out significant commercial undertakings from India but managing their period of stay in India in such a manner to attain the status of NRI i.e. by limiting stay to 181 days or less.

In Condition 2:- No change

At this note, it is pertinent to mention here that said stringent amendment to test the determination of tax residency status of such individuals were brought by Finance Act, 2020 before lockdown. Post COVID-19 and subsequent lockdown, we are standing in third month of FY 2020-21 and still lot of uncertainties are persisting due to international travel restrictions. Cogitating the genuine hardship caused due to unpresented times, Government of India issued clarification in May 2020 in respect of tax residency status of NRI.

Clarification in respect of residency under section 6 of the Income-tax Act, 1961 – Circular 11 of 2020 dated 08th May 2020

It is pertinent to reiterate that taxability under Income Tax in India is being decided based on the number of days residing in India. Recent amendment as mentioned above has been introduced by the Finance Act 2020 related to the residential status.

In this respect, various representations were made to Central Board of Direct Taxes (CBDT) in India stating that there are number of individuals who had come on a visit to India during the previous year 2019-20 for a particular duration and intended to leave India before the end of the previous year for maintaining their status as non-resident or not ordinary resident in India. However due to declaration of the lockdown and suspension of international flights owing to outbreak of Novel Corona Virus, they are required to prolong their stay in India. This may resulted in involuntarily holding the status of Indian residents by such individuals without any intention to do so and subsequently taxability of their global income in India. Acknowledging the said genuine hardship, CBDT issued circular clarifying as below:-

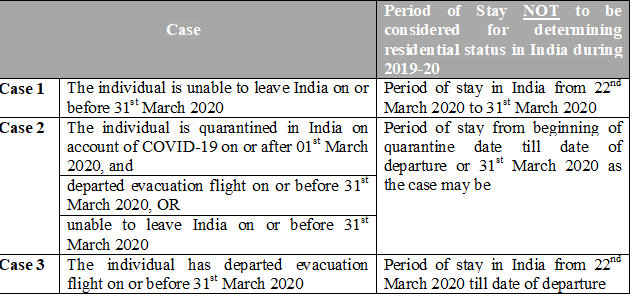

The residential status of individual during previous year 2019-20 who has come to visit India before 22nd March 2020 shall be computed as under:-

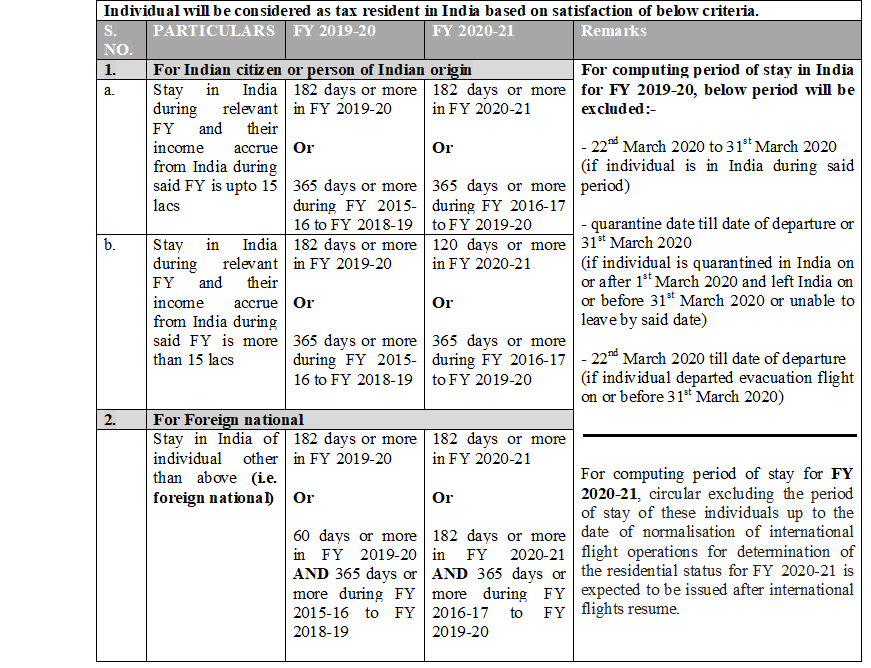

The Circular is suitable and an appreciated move by the Government of India as it has acknowledged the legitimate concerns of individual foreigners and NRI pertaining to their tax residential status in India. However, relief provided by said circular is restricted till 31st March 2020 i.e. no relief has yet been provided for FY 2020-21 and the situation still remain unaltered wherein the lockdown continues during FY 2020-21 and it is not yet clear as to when would international flight operations resume.

In this respect, it is worth mentioning the press release by Government of India addressing said issue wherein it has been assured that a circular excluding the period of stay of these individuals up to the date of normalisation of international flight operations for determination of the residential status for FY 2020-21 will be issued after flights resume.

In view of above amendment in Income tax law and clarifications issued by CBDT, summarised table has been prepared on tax residency status of individual in India for FY 2019-20 and FY 2020-21.

Post determination of status of an individual as a resident, secondary test is to determine whether the individual qualifies as a not ordinary resident (NOR) or ordinary resident (OR) for purpose of taxability of global income in India and declaration of foreign assets in Income Tax return in India. Accordingly, the global income and assets of individual qualifying as OR will be subject to relevant Income Tax law in India.

Further, it would not be out of context apprise on relevant amendment pertaining to deemed resident in India effective from 01-04-2020. As per said amendment, a citizen of India will be deemed to be a resident of India if he is not liable to pay tax in any country outside India on account of his domicile, residence, or any other criteria of a similar nature and his total income other than income from foreign sources exceeds Rs 15 lacs during the financial year.

Conclusion:

Though the clarification issued by Government of India is a welcome move, however, it only deals with determination of tax residency of individuals for FY 2019-20. Further, reducing the stay in India to 120 days in a year from FY 2020-21 onwards without any relief of lockdown days for said financial year standing today is unquestionably creating qualms in the minds of NRI stuck in India including those individuals who are the directors of the foreign company which resulted in exposure of effective management or permanent establishment in India of such foreign companies. Therefore not only the individuals but the foreign company finding themselves in such situation must vigilantly evaluate the residential status of such individuals and subsequently their company in India.