The pandemic situation disrupting “the world”, “the economy” and “the business” on one hand, has also opened up a ton of opportunities making business of supreme importance and the deal terms getting flexible. The market condition reflects the right time to see opportunities in every situation and exploit the opportunities that will surface. Consequently, the businesses are focusing and networking in identifying the performance of the varied sectors and preparing themselves to pull the trigger in growing their business inorganically i.e. through restructuring.

While the prospects will be floating, the businesses must identify the true opportunities and the related tax implications. Many Companies may have the prospect to reinforce and grow by retrieving promising companies which are now in distress due to pandemic effect. This article would provide a detailed insight on germane restructuring prospects and its tax implication from a GST prospective.

Prospect 1: - Transfer of Business as Going Concern

Under this prospect, running business is transferred, which is capable of being carried on by the purchaser as an independent business. As per the Internationally accepted guidelines issued by His Majesty’s Revenue & Customs (also referred by various Advance Ruling authorities in India) under transfer of business as a going concern, , assets must be sold as a part of the business as a going concern and when the purchaser intends to use assets to carry on the same kind of business as the seller. In case only part of the business is sold, it must be capable of a separate operation. Further, there must not be a series of immediately consecutive transfers.

Tax Implication under GST

Where the entire business is sold off as a going/running concern, in such a case, it would be considered as a slump sale – Supreme Court in the case of CIT vs. Equinox Solutions (P.) Ltd.

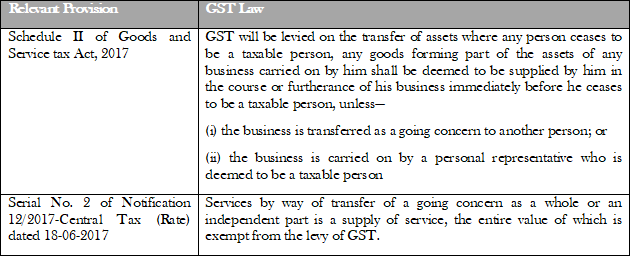

At this point, it is pertinent to analyse the relevant provisions of the GST law as under:-

On the conjoint reading of the above GST provisions, it is evident that the transfer of business as a going concern constitutes of the supply of services but which is exempt from the levy of GST on its transaction value.

Further, in this respect, recently the GST Advance Ruling Authority (GST AAR) in India analysed the applicant’s business transfer agreement from a going concern prospective and held as under:-

- In 2020, GST AAR Uttarakhand in the case of Re Rajiv Bansal and Sudershan Mittal observed that the buyer has purchased the business in order to carry on the same kind of business as the purchaser themselves engaged in. Further, there is no series of immediately consecutive transfers of the said business. The AAR held the business transfer agreement as a going concern as exempt from GST.

- In 2019, GST AAR Uttarakhand in the case of Re Innovative Textile Ltd. held that business transfer agreement of the applicant as a going concern on a slump sale basis is exempted from the levy of GST.

- In 2018, GST AAR Karnataka in the case of M/s Rajashri Foods Pvt. Ltd observed that “the transaction of transfer of business as a whole of one of the units of the Applicant in the nature of a going concern amounts to supply of service and is covered under Sr. No.2 of the Notification No. 12/2017 subject to the condition that the unit is a going concern.”

Prospect 2: - Transfer of Business as itemized sale of assets

Under this prospect, where the business is not transferred as a going concern but the assets and liabilities of a business are transferred by assigning the value to each item, it is termed as an itemized sale. Such a prospect is considered under a slump sale (not as a going concern), merger and amalgamation wherein the whole business is transferred item wise i.e. the value of each asset is calculated separately.

Tax Implication under GST

As per GST provisions mentioned in the table above, the transfer of assets is considered as a supply subject to GST where any person ceases to be a taxable person, any goods forming part of the assets of any business carried on by him shall be deemed to be supplied by him in the course or furtherance of his business immediately before he ceases to be a taxable person.

In other words, GST is levied on itemised sales at the rate applicable to the respective goods in terms of the GST law.

Prospect 3: -- Transfer of Business as sale of securities

Sale of securities is the simplest and most generic method of acquisition of any business. Under this prospect, all the shares of the selling company are transferred to the purchasing company by way of making an offer to the shareholders of the transferor company with a stated price for the purpose.

Tax Implication under GST

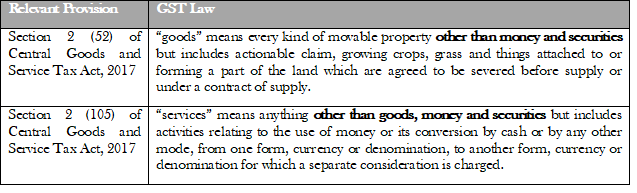

In this respect, it is pertinent to analyse relevant the GST provision.

In view of the above, securities have been explicitly excluded from the purview of GST. Further, as per GST law read with The Securities Contract (Regulations) Act, 1956, securities include shares, scripts, stocks, bonds, derivative instruments, etc.

Thus, the transfer of business through the sale of securities including shares, etc. is not subject to GST.

Before Depart…..

Tax implication is a very crucial issue for the companies considering the prospect of restructuring of business. Apart from this, the availability of relevant cenvat credit of Input and Input services also need proper checks from the GST prospective. Reconstruction of a business requires in-depth analysis of cost benefits, GST implication and appropriate due diligence for such business combinations.