With the outburst of COVID-19 worldwide, the virus has become a part of all critical as well as non-critical discussions and decisions. While the pandemic is transforming the business models, it has become exigent for businesses to sustain

With the outburst of COVID-19 worldwide, the virus has become a part of all critical as well as non-critical discussions and decisions. While the pandemic is transforming the business models, it has become exigent for businesses to sustain financially due to the lockdown and thus thesubsequent drop in revenue. This has resulted in the extension of discounts to the custumers/ clients which are also in the nature of post sales discounts to churn revenue and cash flow for their businesses.

Treatment of discounts under relevant Indian laws depends upon the nature of the discount which determines its taxability. Consequently, it becomes imperative to understand the treatment of discounts and tax implications on the same under GST law in India keeping in mind the new-fangled discounts offered during COVID.

As per GST law, treatment and taxability of discounts depends upon the “time” when the said discount is offered i.e.

In this respect, Section 15(3) of the Central Goods and Service Tax Act (CGST), 2017 provides that

“(3) The value of the supply shall not include any discount which is given––

(a) before or at the time of the supply if such discount has been duly recorded in the invoice issued in respect of such supply; and

(b) after the supply has been effected, if–

(i) such discount is established in terms of an agreement entered into at or before the time of such supply and specifically linked to relevant invoices; and

(ii) input tax credit as is attributable to the discount on the basis of document issued by the supplier has been reversed by the recipient of the supply”.

(emphasis supplied)

Thus, if the discount is offered before or at the time of supply and is mentioned in the invoice separately, in such a case GST will not be levied on such a discount amount. For instance:-

A supplied goods amounting to INR 1000/- to B and offers 5% discount mentioning the same in invoice separately i.e. INR 50/-, in such case GST will be levied on net value amounting to INR 950 (i.e.1000 – 50)

In case the discount is offered after the supply has been effected i.e. post-sale, GST will not be levied on such discount only if the below conditions are met

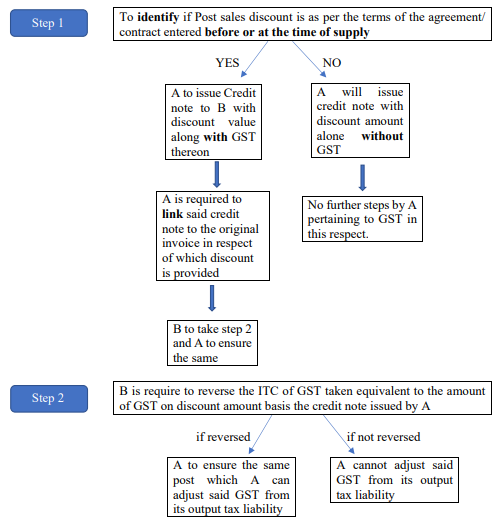

In such a scenario the relevant document for offering discounts to recipients is the “credit note”. And if all the above conditions are satisfied, the supplier will issue the credit note with the value of discount and GST thereon to the recipient. The supplier thereafter can adjust the said GST amount from its total output tax liability. Thus, in our example above, if A offers post sales discount to B, in such a case, A and B have to follow the steps given below:-

|

Further, Central Board of Indirect Taxes and Customs issued clarifications on various doubts related to treatment of secondary or post sales discounts under GST.

These are the discounts which are not known at the time of supply or are offered after the supply is already over. The Board clarified that credit note(s) can be issued as a commercial transaction between the two contracting parties. However, such secondary discounts shall not be excluded while determining the value of supply as such discounts are not known at the time of supply and the conditions laid down in section 15(3)(b) of the said Act are not satisfied. In other words, the credit note will be issued with the discount amount alone without GST in such a case. - (Circular No. 92/11/2019-GST dated 07th March 2019)

For the purpose of value of supply, post sales discounts are governed by the provisions of clause (b) of sub-section (3) of section 15 of the CGST Act. It is crucial to examine the true nature of discount given by the manufacturer or wholesaler, etc. to the dealer. (Circular No. 105/24/2019-GST dated 28th June 2019)

Based on the above understanding, discounts offered during COVID situation need proper evaluation to understand the nature of discounts. The Company must analyse its agreement/ contract with vendors entered before or at the time of supply. The Company may want to identify:-

However, in case, the agreement/ contract does not contain any clause pertaining to discount policy, in such a case, the credit note will be issued without the GST amount on the discount value.

In such a scenario, the Company might consider to opt for other schemes such as extending credit limit, discounts on future supplies, etc. to maintain cash flows.

Conclusion

Post sales discount has always been a topic of debate and while the GST law has laid down conditions for treatment of discount for levy of GST on the same, the pandemic has created situations which were never before. Therefore till the time representations are presented before GST councils and clarifications are passed in this respect, each and every discount offered to vendors during COVID should be evaluated vis-a-vis identification of relevant clause in the agreement/ contract.

At the same time, the recipient of goods/ services while making payment (equivalent to net of discounts) should also check for eligibility of ITC of GST paid by them to the vendors. Further in this respect it will not be out of context to mention here that the recipient needs to adhere to the statutory requirements relating to the revision of TDS return, where ever applicable and subsequently refund the excess TDS deducted upon the value of discount, else notices for mismatch of 26AS will be issued.

We appreciate you contacting us at India Law Offices. We will review the details that you have submitted and one of our experts will connect with you shortly.

Here are some of the other related articles authored by our experts which might be of interest to you.