A legal process of incorporation brings a company into existence whereas under liquidation that existence comes to an end. Voluntary Liquidation is, as suggested, winding up of a corporate entity at the instance of its members. The major objective of the voluntary liquidation is minimizing the intervention of court and to enable the members and creditors to settle their affairs among themselves. Only a solvent company is eligible to enforce voluntary liquidation. Other than voluntary liquidation, a company can opt for the Fast Track Exit (FTE) mode, which is striking off the name/deregistration of a company from the Register of Companies u/s 560 of the Companies Act, 1956.

A legal process of incorporation brings a company into existence whereas under liquidation that existence comes to an end. Voluntary Liquidation is, as suggested, winding up of a corporate entity at the instance of its members. The major objective of the voluntary liquidation is minimizing the intervention of court and to enable the members and creditors to settle their affairs among themselves. Only a solvent company is eligible to enforce voluntary liquidation. Other than voluntary liquidation, a company can opt for the Fast Track Exit (FTE) mode, which is striking off the name/deregistration of a company from the Register of Companies u/s 560 of the Companies Act, 1956.

Then and Now:

Prior to the recent notifications, voluntary liquidation was governed by the provisions of the Companies Act, 1956 (1956 Act) as neither the relevant sections of the Companies Act, 2013 (2013 Act) nor the Code were in force. Section 38 and 20 of the 1956 Act and 2013 Act respectively dealt with the voluntary liquidation. Under the 1956 Act, the voluntary liquidation was segregated into two categories: members’ voluntary winding up and creditors’ voluntary winding up.

On 31 March, 2017 the Insolvency and Bankruptcy Board of India (IBBI) vide its notification issued the Insolvency and Bankruptcy Board of India (Voluntary Liquidation Process) Regulations, 2017 which came into force on 1 April 2017. Section 59 of Chapter V of Part II of the Insolvency and Bankruptcy Code, 2016 (Code) is applicable to voluntary liquidation of corporate persons.

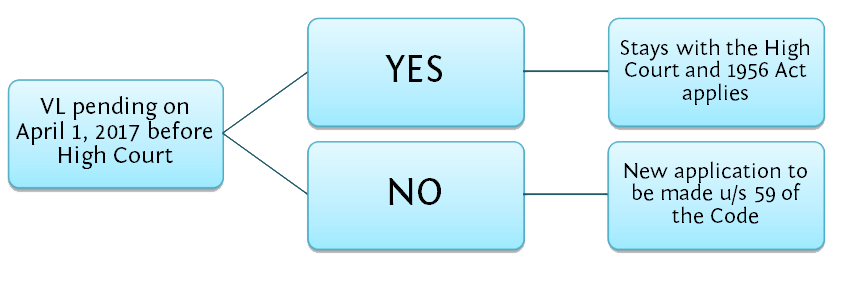

Transfer of Pending Proceedings:

Rule 4 of the Companies (Transfer of Pending Proceedings) Rules, 2016 (Transfer Rules), which has been notified on 7 December 2016 and brought into force from 1 April 2017, prescribes that all applications and petitions relating to voluntary winding up of companies pending before a High Court prior to 1 April 2017, shall continue to be dealt with by the High Court in accordance with the provisions of the 1956 Act. All fresh proceedings for voluntary winding up on and from 1 April 2017 shall be instituted before the NCLT and shall be governed as per the provisions of the Code and the Regulations.

Procedure of Voluntary Liquidation under IBC:

Why Voluntary Winding Up?

Liabilities of a Director shall not continue post the dissolution of the company, except in cases of fraud, misrepresntation etc.

Liabilities of a Director shall not continue post the dissolution of the company, except in cases of fraud, misrepresntation etc.

Under new code, only a licensed professional can act as a liquidator of the company that ensures speedy closure.

Under new code, only a licensed professional can act as a liquidator of the company that ensures speedy closure.

The Code is a single window legislative that has made the closure of the company easier and more uniform as compared to that under the Act,1956.

The Code is a single window legislative that has made the closure of the company easier and more uniform as compared to that under the Act,1956.

Under the new Code, the process is single-handedly run by liquidator with minimal involvement of the adjucating authorities.

Under the new Code, the process is single-handedly run by liquidator with minimal involvement of the adjucating authorities.

Conclusion

The basics of the liquidation process remains the same as it were under Companies Act, 1956, however, the Code reduces the intervention of the regulatory authorities drastically that fasten up the process. Once the winding up process is completed, the liquidator has to make an application to the Tribunal for passing the order of dissolution of the company. Only solvent companies can file for voluntary winding up and approval of creditors is mandatory now unlike earlier in the Act.

With the removal of the concept of official liquidator, the onus of the entire process is on company liquidator, which might improve the liquidation process. The Code appears to be in harmony with the global practices removing overall obstacles which prevailed in older laws, due to which closure of solvent companies has become a lot smoother.

We appreciate you contacting us at India Law Offices. We will review the details that you have submitted and one of our experts will connect with you shortly.

Here are some of the other related articles authored by our experts which might be of interest to you.