To boost economic activity, increase foreign exchange earnings through exports, generate employment and attract foreign direct investment the Government of India created Special Economic Zones or SEZs.

To boost economic activity, increase foreign exchange earnings through exports, generate employment and attract foreign direct investment the Government of India created Special Economic Zones or SEZs. In simple terms, SEZs were developed with an objective of promoting industrialization and economic growth through sustainable development.

What are SEZs?

SEZs are a topographically differentiated region which appreciates liberal monetary laws contrasted with applicable laws pertinent somewhere else in the nation. SEZs are specifically delineated duty-free enclaves and are deemed to be foreign territory for the purposes of trade operations, duties and tariffs. The SEZs are governed by the SEZ Act, 2005 and SEZ Rules, 2016 apart from the Foreign Trade Policy and Handbook of Procedures.

The special feature about SEZ is special economic system and policy where special tax incentives for foreign investment in SEZ and greater independence on international trade activities are provided.

Taxation in SEZs – Section 10AA:

To promote investment in SEZs and to make it look lucrative as compared to investments in other region, the Government of India provides certain tax incentives apart from simplified procedure for statutory approvals and compliances. In order to avail these income tax benefits the unit has to fulfill following conditions:

Condition 1: Assessee, being an entrepreneur as referred to in clause (j) of section 2 of the Special Economic Zones Act, 2005. Entrepreneur is a person who has been granted a letter of approval by the Development Commissioner to set a unit in a Special Economic Zone.

Condition 2: The Unit in Special Economic Zone who begins to manufacture or produce articles or things or provide any services during the previous year relevant to any assessment year commencing on or after the 1st day of April, 2006.

Condition 3: It is not formed by the splitting up, or reconstruction, of a business already an existence.

Condition 4: It is not formed by the transfer to a new business, of old plant and machinery. However, it can be formed by transfer of old plant or machinery to the extent of 20%.

Condition 5: The assessee has income from export of articles or thing or from services from such unit. In other words, the assessee has exported goods or provided services out of India from the Special Economic Zone by land, sea, air, or by any other mode, whether physical or otherwise.

Condition 6: Books of Accounts of the taxpayer should be audited. The Tax payer should submit Audit Report in Form No. 56F along with the return of income.

If the above mentioned conditions are satisfied, the assessee can claim following deduction u/s 10AA:

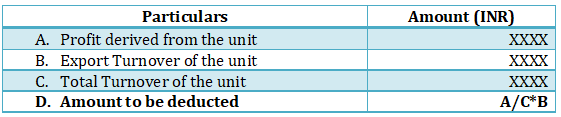

Calculation of Deduction amount:

The amount of deduction allowed under section 10AA is computed as below:

Therefore, Amount allowed for deduction = Profit from the unit * Export Turnover of unit

Total Turnover of the unit

SEZ and GST:

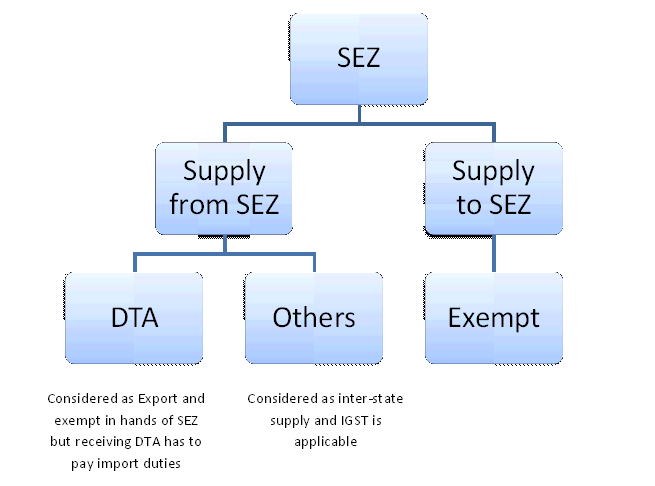

With other indirect taxes eliminated and arrival of GST, being in SEZ can be advantageous while filing GST return too. Any supply of goods or services made to a SEZ developer or unit will be considered to be a zero-rated supply. This means that under GST these supplies will attract Zero tax rate. In simple terms, supplies into SEZ are considered as exports and are exempt from GST.

However, when a SEZ unit supplies goods or services to any one, it will be treated as a regular inter-state supply and will attract IGST. In exception to above, when a goods or services are supplied to a Domestic Tariff Area (DTA), it will be considered as an export to DTA and customs duties and other import duties will be payable at the hand of person receiving these supplies in DTA.

Conclusion:

The SEZ Act provides right mix of facilities and support to build infrastructure for attracting FDI. Indian Government’s initiative with SEZ Act and SEZ Rules are steps in right direction aiming to encourage exports and employment, however it is important that these tax incentives are calibrated with present taxation scenario.

We appreciate you contacting us at India Law Offices. We will review the details that you have submitted and one of our experts will connect with you shortly.

Here are some of the other related articles authored by our experts which might be of interest to you.