Switzerland the Right Choice for your Business

Switzerland is one of the world’s most attractive business locations as the country has shown stability, competitive taxation and international market access.

Switzerland is ranked among the

top 5 globally for political stability and ease of doing business. Its legal framework is reliable, with low corruption and efficient dispute resolution.

Competitive Tax Landscape

Federal corporate income tax is set at 8.5%, and combined federal, cantonal, and communal

rates typically range between 12% and 21%, depending on location. Cantons such as Zug and Lucerne are especially attractive for international businesses. Switzerland also has more than

100 double taxation agreements, including India, ensuring efficient cross-border tax planning.

Gateway to Europe

Located at the heart of Europe, Switzerland offers direct access to the

EU and EFTA markets through bilateral agreements. The country offers world class transport and logistics infrastructure helping companies based here to reach over millions of consumers based in Europe.

International Reputation

Establishing a company in Switzerland offers a strong global image and credibility which eventually helps you attract investors, open foreign bank accounts and connect with international partners.

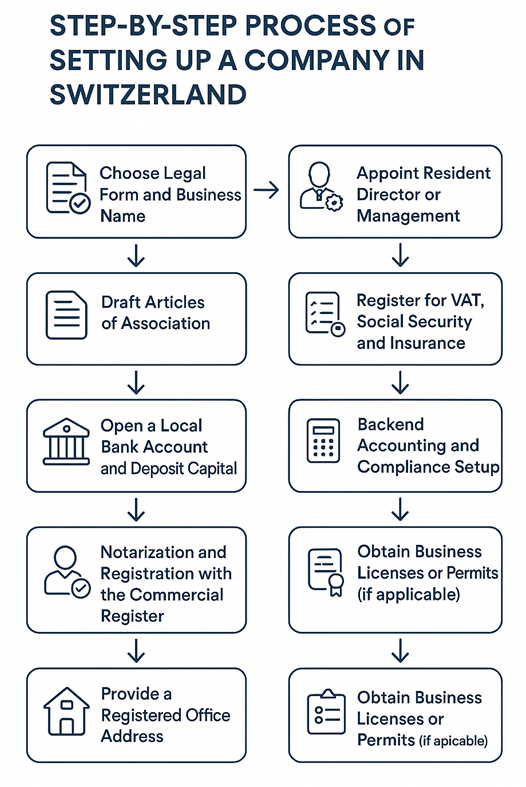

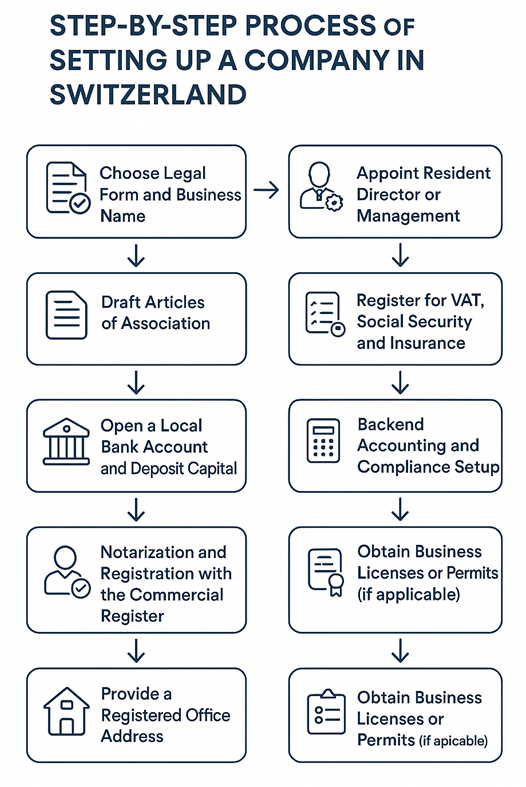

Process of Setting Up a Company in Switzerland

Setting up a business in Switzerland requires following a structured process. While exact steps may vary by canton and business form, the key stages are generally the same.

1. Choose Legal Form and Business Name

- Decide whether an AG, GmbH, sole proprietorship, or branch suits your business.

- Conduct a name check with the Swiss Commercial Register to ensure availability and compliance.

- Timeline: 1–2 days.

2. Draft Articles of Association

- The document defines the company’s purpose, governance, and share capital. (Mandatory for AGs and GmbHs).

- Timeline: usually 1 week.

3. Open a Local Bank Account and Deposit Capital

- For limited liability companies, share capital must be deposited in a Swiss bank (blocked until registration).

- After registration, set up a regular operational account.

- Timeline: 1–2 weeks (bank KYC procedures may extend this).

4. Notarization and Registration with the Commercial Register

- Founders sign incorporation documents before a Swiss notary.

- The notary files documents with the cantonal Commercial Register.

- Timeline: 1–2 weeks.

5. Provide a Registered Office Address

- All companies must have a Swiss physical address for legal correspondence.

- Many clients use domiciliation services if no physical office is needed.

6. Appoint Resident Director or Management

- Swiss law requires at least one director or manager to be a resident in Switzerland for AGs and GmbHs.

- Resident directors can also serve as the company’s legal representative for authorities, registration and compliance matters.

7. Register for VAT, Social Security, and Insurance

- VAT registration is required for businesses with annual revenue over CHF 100,000.

- Employers must register employees for social security (AHV), accident insurance, and occupational pension.

8. Backend Accounting and Compliance Setup

- Implement bookkeeping, annual financial statements, payroll, and tax filing processes.

- Many companies use local fiduciaries or accounting partners to maintain compliance.

9. Obtain Business Licenses or Permits (if applicable)

- Certain industries such as finance, healthcare, food, and many more will require regulatory approval before initiating operations.

Timeline

For a standard AG or GmbH:

- Preparation, articles, and capital deposit: 1 to 3 weeks

- Notarization and registration: 1 to 2 weeks

- Post-registration formalities (VAT, social security, permits, accounting setup): 2 to 4 weeks

Average total duration: 4–8 weeks from initial planning to full operational readiness.

Business Structures in Switzerland — Finding the Right Fit

Choosing the right legal form is the most important decisions when setting up a company in Switzerland. The structure you select will affect liability, governance, and how your business is perceived by partners and investors.

To be recognized as a “Swiss Company”, it must register using one of the legally recognized company forms, typically referred as AG or GmbH, ensuring authorised capital is paid up.

Public Limited Company (Aktiengesellschaft – AG)

- Minimum capital: CHF 100,000 (at least CHF 50,000 paid in).

- Liability: Limited to company assets. Shareholders are not personally liable.

- Governance: Requires at least one director domiciled in Switzerland.

- Suitability: Preferred by larger businesses, holding companies, and those seeking outside investment. The AG is highly respected internationally and often chosen by foreign investors.

Limited Liability Company (Gesellschaft mit beschränkter Haftung – GmbH)

- Minimum capital: CHF 20,000 (fully paid in).

- Liability: Limited to company assets.

- Governance: At least one managing director must reside in Switzerland.

- Suitability: Common for small and medium-sized enterprises. More flexible than an AG but still offers strong legal standing.

Sole Proprietorship

- Capital: No minimum capital requirement.

- Liability: Unlimited, the owner is personally liable for all business debts.

- Registration: Required to be commercially registered if turnover exceeds CHF 100,000 per year.

- Suitability: Best for small, one-person businesses or freelancers. Might not be ideal for larger operations or international trade.

Branch of a Foreign Company

- Capital: No separate share capital required.

- Liability: Parent company must remain fully liable.

- Governance: Requires at least one representative as a Swiss resident.

- Suitability: Good option for foreign firms who are looking to establish a presence without creating a separate legal entity.

Few Important Points to Consider

When setting up a business in Switzerland, there are additional points which needs to be considered.

Acquisition of Shelf Companies

To save time, some investors choose to acquire “shelf company - already-registered but not yet active entities. These entities are legally dormant but allow faster market entry, as the capital is already paid in and registration formalities are complete. Proper due diligence is essential before purchase.

Employment Law and Social Contributions

Swiss labour laws are business-friendly but also highly regulated in certain areas. Employment contracts must follow mandatory rules on notice periods, working hours, and the social security contributions. Employers are required to register their staff with the old-age and survivors’ insurance (AHV), accident insurance, and pension funds. Failing to comply with these rules can lead to penalties or reputational risks.

Residency and Permits

At least one director or manager must be resident in Switzerland for an AG or GmbH. For foreign entrepreneurs, obtaining the right permit is essential. EU/EFTA nationals benefit from simplified processes, while non-EU nationals must demonstrate business purpose and economic benefit to Switzerland.

How Our Firm Can Help You

With our extensive experience in helping international businesses especially in establishing a presence in Europe, our firm is well-equipped to support your expansion plans in Switzerland. We can help you in:

- Market Study & Feasibility: Assess opportunities and viability for your business in Switzerland and help you build a tailored market entry roadmap.

- Partner & Investor Search: Identify local partners, distributors, or collaborators to accelerate growth.

- Incorporation & Compliance: Assistance with setting up a subsidiary or branch, opening bank accounts, providing registered office and resident director services, VAT registration, bookkeeping, and statutory filings.

- Tax & Regulatory Strategy: Choose the best canton, plan cross-border taxes efficiently, and obtain sector-specific regulatory approvals.

- Ongoing Legal Support: From corporate governance, contracts, and dispute resolution to intellectual property protection, employment law, and immigration support, we ensure your business operates smoothly.

Switzerland offers a strategic location, favourable tax framework, and strong business ecosystem for international companies. Let’s explore how your company can succeed in Switzerland!