Background

With effect from 1 July 2017 Goods and Services Tax (GST) law has become operational and existing laws have been repealed. GST is a significant reform in the field of indirect taxes in India. Multiple taxes levied and collected by the Centre and States are replaced by one tax called Goods and Services Tax (GST). GST is a multi-stage value added tax on consumption of goods or services or both.

Timely refund mechanisms are crucial in tax administration to encourage commerce by releasing blocked money for working capital, corporate expansion, and modernisation.

The GST law’s refund provisions work to standardise and streamline the processes for refunds under the GST system. Therefore, there is a standardized form for submitting any refund claims under the GST regime. The claim and sanctioning process is entirely online and time-limited, which represents a significant improvement over the previous labour intensive and time-consuming process.

Conditions Giving Rise to Refund Requests

Section 54 of the CGST Act, 2017, provision contained in Section 77 of the CGST Act, 2017 and the requirement of submission of relevant documents as listed in Rule 89(2) of CGST Rules, 2017 is an indicator of the various situations that may necessitate a refund claim. A claim for refund may arise on account of:

- export of goods or services;

- supplies to Special Economic Zone (SEZs) units and developers;

- supply of goods regarded as Deemed Exports;

- refund of taxes on purchase made by UN or embassies etc. (under Section 55 of CGST Act, 2017);

- refund arising on account of judgment, decree, order or direction of the Appellate Authority, Appellate Tribunal, or any court;

- refund of accumulated Input Tax Credit on account of inverted rate structure; (g) finalisation of provisional assessment;

- refund of pre-deposit;

- tax paid in excess/by mistake;

- refunds to international tourists of GST paid on goods in India and carried abroad at the time of their departure from India (not notified yet);

- refund of tax paid in wrong head under Section 77 of CGST Act, 2017 & Section 19 of IGST Act, 2017 (treating the supply as intra-State supply which is subsequently held as inter-State supply and vice versa);

- refund on account of any other reasons;

Under Section 54(3) of the CGST Act, 2017, a registered person may claim refund of unutilised Input Tax Credit at the end of any tax period. A tax period is the period for which return is required to be furnished. Refund of unutilised Input Tax Credit is allowed only in following two scenarios:

- Zero rated supplies made without payment of tax;

- Inverted duty structure.

Timeline for Application of Refund

The GST law requires that every claim for refund is to be filed within 2 years from the relevant date. Relevant date depends on the circumstances under which the refund is applied for. The following table summarises the relevant dates for application of refund in various conditions:

| S. No. |

Scenario |

Relevant Date |

Remarks |

| 1 |

The refund claim on export of goods or the accumulated Input Tax Credit (ITC) |

Date on which the goods departure from India via air/land/sea. |

If the goods are sent via post, the relevant date would be the date on which such good is dispatched by the post. |

| 2 |

The refund claim on export of services or the accumulated ITC |

Date when the invoice is issued. |

If the taxpayer receives the invoice before the receipt of payment, then the relevant date will date on which the payment will be received. |

| 3 |

Refund for Deemed Exports |

Date on which the GST return will be furnished by the taxpayer containing the details of Deemed Exports. |

|

| 4 |

Refund due to any judgement / decree / order / direction |

Date when such judgment/decree/order/direction is communicated to the taxpayer. |

|

| 5 |

Unutilized ITC |

The due date for furnishing of return under Section 39, CGST Act for the period in which such claim for refund arises. |

|

| 6 |

Refund of provisionally paid tax |

The relevant date for claiming a refund under GST will be the date when such amount is adjusted after the final assessment. |

|

| 7 |

Refund claimed by any other person apart from the supplier |

Date of receipt of goods/services. |

|

Refund with respect to Zero-Rated Supplies made with Payment of Tax

- Service Exporters and Persons making supplies to SEZ

The supplier may choose to first pay IGST and then claim refund of the IGST so paid. In these cases, the suppliers will have to file refund claim in FORM GST RFD – 01 on the common portal, as per Rule 89 of the CGST Rules, 2017. Service Exporters need to file a statement containing the number and date of invoices and the relevant Bank Realisation Certificates or Foreign Inward Remittance Certificates, along with the refund claim.

The normal refund application in GST RFD-01 is not applicable in this case. There is no need for filing a separate refund claim as the shipping bill filed by the exporter is itself treated as a refund claim. As per Rule 96 of the CGST Rules, 2017, the shipping bill filed by an exporter shall be deemed to be an application for refund of integrated tax paid on the goods exported out of India and such application shall be deemed to have been filed only when:

- The person in charge of the conveyance carrying the export goods duly files an export manifest or an export report covering the number and the date of shipping bills or bills of export;

- The applicant has furnished a valid return in FORM GSTR-3B.

Refund of Unutilised ITC in respect of Zero-rated Supplies made without Payment of Tax

- Documentary evidence as may be prescribed to establish that a refund is due to the applicant, as well as such documentary or other evidence as the applicant may furnish to establish that the amount of tax and interest, if any, paid on such tax or any other amount paid in relation to which such refund is claimed, was collected from, or paid by, the applicant is required to be included with the application for refund of unutilised ITC on account of zero-rated supplies (without payment of tax under Bond/LUT). This application is made electronically on the GST portal in FORM GST RFD-01.

- In cases where the application relates to the refund of an input tax credit, according to clause 89(3) of the CGST Rules, 2017, the applicant must debit the electronic credit ledger in an amount equivalent to the refund that is being requested.

- As per Section 54(7), The final repayment sanction or rejection order must be granted within 60 Days of the application's complete receipt,

- According to Rule 91 of the CGST Rules, 2017, the provisional refund must be awarded within 7 days of the date on which the refund claim was acknowledged. The order for the provisional refund must be issued in Form GST RFD 04 and must be accompanied by a payment order in the claimant's name in Form GST RFD 05. The rules also state that a provisional refund will not be given if the person requesting it has, within the five years immediately preceding the tax period to which the refund claim relates, been charged with any offense under the Act or under a previous law where the amount of tax evaded exceeds INR 2.5 Cr.

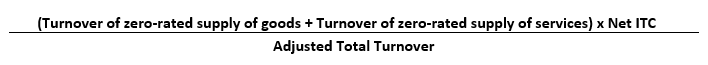

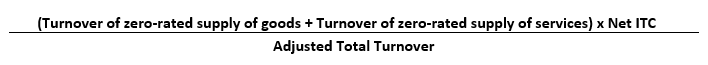

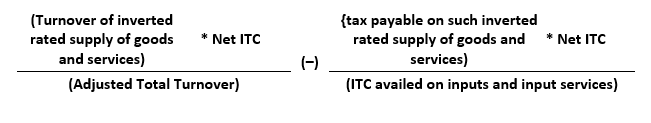

Maximum Amount of refund is given by the following formula:

Refund of Unutilised ITC with respect to Inverted Duty Structure

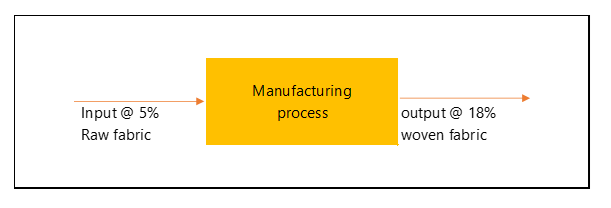

An inverted tax structure simply refers to a condition where the tax rate on inputs used is higher than the tax rate on the outputs for sale. For example, fabric bags are finished goods being sold at a 5% GST. Non-woven fabric, which is a raw material used to make fabric bags, is purchased at a 12% GST.

Refund claims on account of inverted duty structure shall be filed for a tax period or by clubbing tax periods in FORM GST RFD-01. However, the registered persons that have an Aggregate Annual Turnover of up to INR 1.5 Cr in the preceding financial year or the current financial year and opting to file FORM GSTR-1 on quarterly basis shall apply for refund on a quarterly basis or by clubbing quarters.

Further, the refund claim for a tax period may be filed only after filing the details in FORM GSTR-1 for the said tax period. It is also to be ensured that a valid return in FORM GSTR-3B has been filed for the last tax period before the one in which the refund application is being filed.

Circular No.79/53/2018 (rescinded vide Circular No. 125/44/2019-GST dated 18.11.2019) has issued further clarifications in respect of refund claim of inverted rate structure as under:

Refund of unutilized ITC in case of inverted tax structure, as provided in Section 54(3) of the CGST Act, 2017 is available where ITC remains unutilized even after setting off available ITC for the payment of output tax liability. Where there are multiple inputs attracting different rates of tax, in the formula provided in Rule 89(5) of the CGST Rules, 2017 the term “Net ITC” covers the ITC availed on all inputs in the relevant period, irrespective of their rate of tax.

Declaration of the applicant to the effect that the incidence of tax has not been passed to any other person will suffice to process the refund claim. For refund claims exceeding INR 2 Lakh, a certificate from a Chartered Accountant/ Cost Accountant must be given.

Exceptions where the refund of the unutilized input tax credit cannot be claimed:

- Output supplies are nil-rated or fully exempt supplies, except for supplies of goods or services or both as may be notified by the Government on the recommendations of the GST Council.

- If the goods exported out of India are subject to export duty.

- If the supplier claims a refund of output tax paid under the IGST Act.

- If the supplier avails duty drawback or refund of IGST on such supplies.

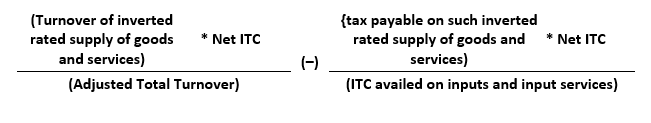

Maximum Amount of refund is given by the following formula:

Documentation

The applicant is not required to submit complex papers with the refund application. Standardised and simple to understand documents, as listed below, have been mandated:

- Main document prescribed is a statement of relevant invoices (not the invoices itself) pertaining to the claim. A statement containing the number and date of invoices as provided in Rule 46 must be submitted.

- The relevant bank realisation certificates or Foreign Inward Remittance Certificate (FIRC) evidencing receipt of payment in foreign currency.

- If it is a claim made by the supplier to the SEZ unit.

- An endorsement from the proper officer evidencing receipt of such goods/services in the SEZ.

- Declaration to the effect that tax has not been collected from the SEZ unit or the SEZ developer.

- If the claim is for refund of accumulated ITC on account of inverted rate structure –

- A statement containing the number and the date of the invoices received and issued during a tax period needs to be given.

- Declaration of the applicant to the effect that the incidence of tax has not been passed to any other person.

- For refund claims exceeding INR 2 Lakh, a certificate from a Chartered Accountant/ Cost Accountant must be given.

- In case of claim of refund on account of any order or judgment of appellate authority or court – the reference number of the order giving rise to refund should also be given.

Timeline for Issue of Refund

The GST Department has a period of

60 days to issue the refund to applicant on fulfilment of above-mentioned conditions and documentation or reject the application after giving opportunity of being heard.

It should be noted that a tax refund is only regarded to have occurred if the money has been credited to the claimant's bank account. As a result, interest will be computed from the day after the passing of 60 days from the date of receipt of the application until the day the money is credited to the claimant's bank account. As a result, it has been advised that all tax authorities issue the final sanction order in FORM GST RFD-06 within 45 days of the date the (ARN) was generated.

Conclusion

GST refunds can be claimed, provided initially when service was paid for, the GST was collected by the service provider, however, the same service was not availed by the individual or the contract was cancelled.

Earlier, there was no mechanism for claiming the refund of GST deposited in the previous financial year with the government, on long term contracts. To close this loophole, a mechanism for customers to claim refund of such GST was announced by the GST council meeting on December 17, 2022. Now the customer can apply for a GST refund with the GST authorities.

We can address your concerns related to procedures to obtain GST refund. You can get in touch with us by filling the form below.